Construction loans could have increased fascination charges than regular home finance loan loans. The cash can be compensated out in installments as design receives underway and continues instead of to be a lump sum.

Here are a few examples of the many repair service and remodel costs You should utilize the loan proceeds for, whether you’re applying a standard or minimal 203(k) rehab loan:

Raise or lower the amount of household units, so long as the ultimate range is one particular to four models

Editorial Observe: We earn a commission from spouse inbound links on Forbes Advisor. Commissions do not have an effect on our editors' viewpoints or evaluations. Getty Irrespective of whether you’re purchasing a house or refinancing one particular, an FHA 203(k) loan may help for those who don’t have enough dollars or equity to obtain a residence equity loan.

To qualify for an FHA 203(b) loan, you’ll need to have to fulfill precise rules established through the Federal Housing Administration. Here's the checkpoints to satisfy if you need to qualify:

Based on your credit and finances, a 203(k) loan might be simpler to qualify for, but a development loan has less limitations within the types of advancements you could finance.

Bankrate.com is undoubtedly an independent, promotion-supported publisher and comparison provider. We are compensated in Trade for placement of sponsored services, or by you clicking on specified backlinks posted on our site. Thus, this compensation may perhaps effect how, where and in what purchase products show up inside listing groups, except the place prohibited by regulation for our house loan, home fairness and also other home lending merchandise.

“Pro verified” ensures that our Financial Critique Board completely evaluated the article for accuracy and clarity. The Assessment Board comprises a panel of monetary authorities whose objective is in order that our material is always goal and well balanced.

Occupancy and citizenship specifications Should make use of the home for a Key residence; not qualified for investment decision Attributes.

Make around 5% income back in home finance loan personal savings on each faucet or swipe - utilizing the card created with dwelling in your mind.

Sarah Sharkey is a private finance writer who enjoys diving into the details that will help readers make savvy money choices.

Instant fairness possible: Purchase a house underneath current market worth and get equity following repairs are complete.

The minimum amount residence requirements call for that click here the home is structurally sound without having health and fitness or protection hazards.

People today commonly make use of the FHA 203(k) loan for home purchases, however it’s also useful for refinancing. You could possibly use this refinancing alternative if your enhancements total no less than $5,000. Lenders would require an appraisal to incorporate equally The existing house benefit as well as improved price following renovations.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Samantha Fox Then & Now!

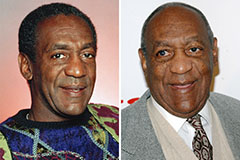

Samantha Fox Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!